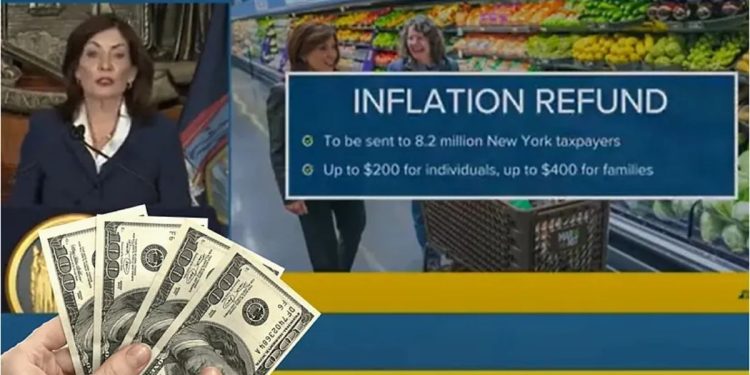

After months of lobbying and negotiations, New York Governor Kathy Hochul has announced the passage of the Fiscal Year 2026 state budget. A key feature of this budget is the long-awaited inflation rebate checks, a promise that had been discussed extensively and now materialized into a reality. Here’s a detailed breakdown of the highlights and the inflation rebate program.

New York’s FY 2026 Budget Overview

Governor Kathy Hochul’s administration has worked diligently with legislative leaders to finalize a balanced and fiscally responsible budget for the state of New York. The proposed budget, which has been officially agreed upon, stands at a total of $254 billion, with no increases to state income or business taxes. This reflects Hochul’s commitment to maintaining fiscal responsibility while addressing the needs of New York families.

Hochul’s administration has worked alongside legislators to ensure the implementation of several key priorities that will benefit New Yorkers. This collaboration resulted in the delivery of much-anticipated relief measures aimed at easing the economic challenges many state residents face due to inflation.

Inflation Rebate Checks: A Tangible Relief for New Yorkers

A major highlight of the FY 2026 budget is the inclusion of direct cash assistance through inflation rebate checks. Governor Hochul has confirmed that the first round of these checks has already been issued, marking a significant achievement for the state. The initiative will direct $2 billion in relief to over 8 million residents across New York, with checks of up to $400 per family.

The rebate program comes as a response to inflation-driven cost-of-living increases, aiming to provide much-needed financial relief to those who need it most. Governor Hochul’s commitment to these checks was underscored in a report, where she expressed pride and optimism about the impact the payments will have on families in the state.

Eligibility for the Inflation Rebate

The inflation rebate checks are intended to provide relief to a wide range of New York residents, with specific eligibility criteria based on income levels. Initially, the proposal set higher payments for qualifying families and individuals, with a $500 rebate for families earning less than $300,000 annually and $300 for individual taxpayers earning less than $150,000.

However, the final agreement adjusted the amounts slightly. The rebate checks now offer up to $400 per family, still representing significant financial assistance for New Yorkers impacted by inflation. The state anticipates that the rebate checks will help ease the burden for families and individuals as they navigate the rising costs of everyday living.

The Budget’s Broader Impact

Beyond the inflation rebate checks, the FY 2026 budget brings forth various other priorities aimed at bolstering the state’s economic health. The budget remains balanced without increasing state taxes, focusing instead on utilizing excess sales tax revenue—largely driven by inflation— to fund the rebate initiative.

Governor Hochul has emphasized that these efforts will have lasting positive impacts on New York families. She stressed that although it took time to finalize, this budget will help New Yorkers navigate the challenging economic conditions of the past few years. The fiscal responsibility and commitment to meeting the needs of the state’s residents are key takeaways from the 2026 budget.

Conclusion

The enactment of New York’s Fiscal Year 2026 Budget marks a significant moment for the state, with the $2 billion inflation rebate program offering essential relief to millions of residents. Governor Hochul’s successful negotiation of this budget ensures that New York families will receive much-needed financial support as they cope with inflationary pressures. With no new tax increases and a commitment to fiscal responsibility, the budget exemplifies New York’s determination to support its residents during uncertain economic times.

Are you kidding me. Since when is $400. a significant assistance to families? It is intended to buy votes and nothing else, in my opinion.

How will I receive the money, People that has only one income and it is SSA doesn’t need to file incometax.

and what does she think $300 or $400 will do for a family, that will just about get groceries 1 time….Really, NY taxes the crap out of it’s residents and they think a measly $400.00 is going to help..SMDH

What about those on social security or those with income low enough that they aren’t required to file taxes??